Professionals have years of experience with tax preparation, religiously attend tax seminars, read scores of journals, magazines and monthly tax tips, among other things, to correctly interpret the changing tax code.

When it comes to tax planning for small businesses, the complexity of tax law generates a lot of folklore and misinformation that also leads to costly mistakes. With that in mind, here is a look at some of the more common small business tax misperceptions.

1. All Start-Up Costs Are Immediately Deductible

Business start-up costs refer to expenses incurred before you actually begin operating your business. Business start-up costs include both start-up and organizational costs and vary depending on the type of business. Examples of these types of costs include advertising, travel, surveys and training. These start-up and organizational costs are generally called capital expenditures.

Costs for a particular asset (such as machinery or office equipment) are recovered through depreciation or Section 179 expensing. When you start a business, you can elect to deduct or amortize certain business start-up costs.

For tax years beginning in 2010, you can elect to deduct up to $10,000 of business start-up costs paid or incurred after 2009. The $10,000 deduction is reduced (but not below zero) by the amount such start-up costs exceed $60,000. Any remaining costs must be amortized.

2. Overpaying The IRS Makes You “Audit-Proof”

The IRS doesn’t care if you pay the right amount of taxes or overpay your taxes. They do care if you pay less than you owe and you can’t substantiate your deductions. Even if you overpay in one area, the IRS will still hit you with interest and penalties if you underpay in another. It is never a good idea to knowingly or unknowingly overpay the IRS. The best way to “Audit Proof” yourself is to properly document your expenses and make sure you are getting good advice from your tax accountant.

3. Being incorporated enables you to take more deductions.

Self-employed individuals (sole proprietors and S Corps) qualify for many of the same deductions that incorporated businesses do, and for many small businesses, being incorporated is an unnecessary expense and burden. Start-ups can spend thousands of dollars in legal and accounting fees to set up a corporation, only to discover soon thereafter that they need to change their name or move the company in a different direction. In addition, plenty of small business owners who incorporate don’t make money for the first few years and find themselves saddled with minimum corporate tax payments and no income.

4. The home office deduction is a red flag for an audit.

While it used to be a red flag, this is no longer true – as long as you keep excellent records that satisfy IRS requirements. Because of the proliferation of home offices, tax officials cannot possibly audit all tax returns containing the home office deduction. In other words, there is no need to fear an audit just because you take the home office deduction. A high deduction-to-income ratio, however, may raise a red flag and lead to an audit.

5. If you don’t take the home office deduction, business expenses are not deductible.

You are still eligible to take deductions for business supplies, business-related phone bills, travel expenses, printing, wages paid to employees or contract workers, depreciation of equipment used for your business, and other expenses related to running a home-based business, whether or not you take the home office deduction.

6. Requesting an extension on your taxes is an extension to pay taxes.

Extensions enable you to extend your filing date only. Penalties and interest begin accruing from the date your taxes are due.

7. Part-time business owners cannot set up self-employed pensions.

If you start up a company while you have a salaried position complete with a 401K plan, you can still set up a SEP-IRA for your business and take the deduction.

A tax headache is only one mistake away, be it a missed payment or filing deadline, an improperly claimed deduction, or incomplete records. Understanding how the tax system works is beneficial to any business owner, whether you run a small- to medium-sized business or are a sole proprietor. And, even if you delegate the tax preparation to someone else, you are still liable for the accuracy of your tax returns.

Richard L. Lipton CPA & Associates LLC, located in Florham Park, N.J., draws on its founder’s 10 years as a stockholder and manager of family-owned Sam’s Tire Co. in Paterson, N.J.

Richard L. Lipton CPA & Associates LLC “is structured to personally serve large and small clients who have a need for business consulting services as well as accounting and tax services. We have even developed a niche in the area of forensic accounting. Our clients have realized that this combination of skills is extremely valuable in providing the highest quality professional services in today’s and the future’s economy.” – Richard L. Lipton CPA Contact Richard L. Lipton CPA & Associates LLC: Call: 973-520-8123 E-mail: [email protected] Web: www.liptoncpa.com.

Article courtesy Tire Review.

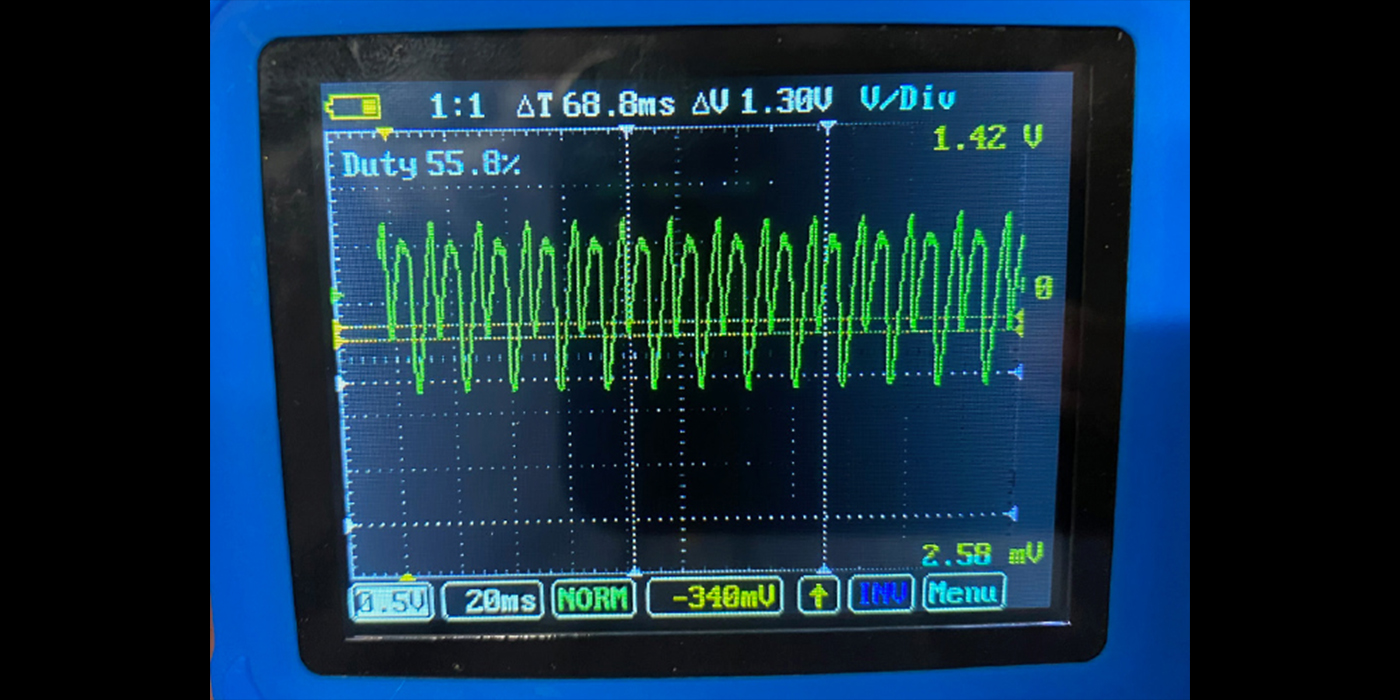

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.