In order to build a successful auto repair shop, there are a number of things you will have to do. You will need to have clearly defined goals, a plan, and you will need to surround yourself with successful people. You will need gifted techs and advisers, a great support staff, the help of marketing professionals and business coaches, and a great accountant as well. Unfortunately, most shop owners don’t understand how to find the really great accountants, they don’t know what to expect from them, and they don’t know how to utilize their services. With our changing economy, and the ever-increasing tax burdens we face in business, now more than ever before, you need to be working with a great accountant. What I would like to do with this article is help take the mystery out of the relationship most shop owners have with their accountants to help you build a more profitable business.

Putting first things first, the overwhelming majority of shop owners make two mistakes with their accountants: they use them as overpaid bookkeepers, and they feel their accountant should be giving them business advice. Unfortunately, that’s the furthest from the truth. Unless your accountant knows the key performance indicators that are hit by the top shops in America, what the loaded cost of labor should be for a profitable shop, and what the top shops generate in part profit as a percentage of sales, they’ll be hard pressed to tell you where you can improve. In essence, with rare exception, accountants don’t know your business. Over the years I have learned that we need to look to accountants for help with one thing, and one thing only; reducing our tax liabilities.

So here are my recommendations if you want to build a more profitable business. First of all, make sure you are using a good accounting software program, such as QuickBooks. You’ll also need to make sure you have a well-designed chart of accounts, and you’ll need to have a general understanding of business finance. You don’t need an accounting degree, but you should have an understanding of terms like gross profit, operating expenses and cost of sale. Secondly, you will need to know the ideal targets for your key performance indicators. These are the numbers hit by the top shops in America, and knowing them will allow you to look at your income statement and quickly see where you are doing well, and where you can improve.

The third thing you will need to do is ensure you have a great accountant. When looking for the right person, you will need to keep two rules in mind. Rule number one simply states that if we put out peanuts we will get monkeys. Choosing an accountant is no different than choosing a good mechanic; you get what you pay for. There is a reason the cheap accountants are cheap, and the good ones are not cheap because they produce a good return on investment. Where do you find the superstar accountants? You will find they typically represent higher income earners that need to maximize their tax savings, so the best place to start is by asking your attorney, your doctor and any other high income earners you know for referrals.

Once you have the right accountant, you will need to meet with them at least twice a year. Your first meeting should be during the first half of the year to review your shop’s year-to-date performance, to project your yearly income, and to start the conversation about your tax strategy. You should then meet again in the third quarter to ensure you are on track, and make any necessary adjustments.

In closing, the top notch accountants will typically help you save a lot of money, and will ensure you are in compliance with all relative tax laws. The low-priced accountants? Just like hiring the low-priced technicians, more often than not they will cost you an absolute fortune.

For additional help building a more profitable, successful auto repair business, learn about how you can join a team of 90 of the top shop owners in the country through Elite Pro Service.

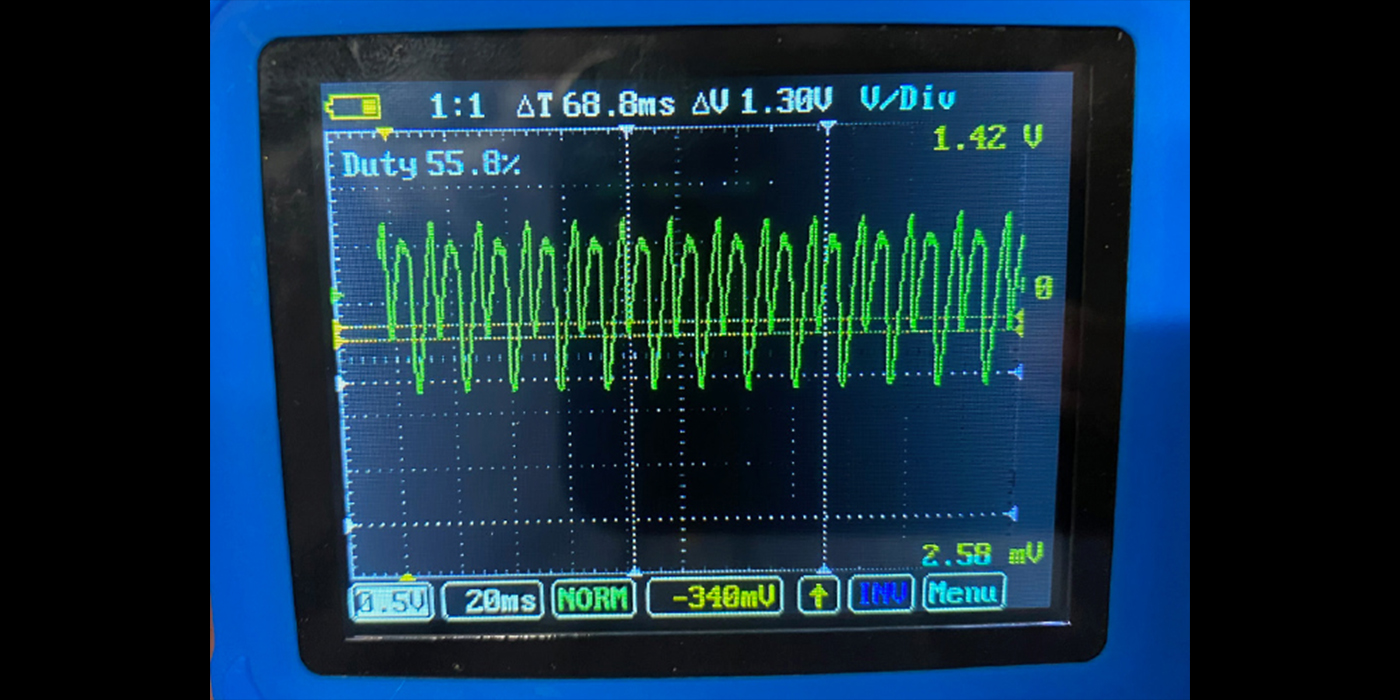

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.