Business plans are for start-ups, right? Why would an established business need one? The fact is, the questions you have to answer as a start-up get forgotten in the daily hubbub of running a business. A little time spent asking some basic questions can trigger new opportunities, greater freedom or both.

If you are reading Shop Owner, you are already in business. You have your business strategy well in hand and things have been running along just fine. And, besides, you are not a start-up trying to raise capital. Why would you need a business plan now?

Unless you invested in your business out of personal savings or took over the business from someone in the family, there is a pretty good chance you wrote a business plan at some point. Bankers want to see business plans (even if they don’t believe them) and sophisticated investors won’t even talk to you without one. It is also possible that, even if you did not need to raise capital to start your business, you were enlightened enough to prepare a plan just for yourself.

Assuming that you did prepare a business plan at one time, odds are that it has not been updated since you wrote it.

Uncomfortable?

Even if you have never written a formal business plan, the questions often answered in such a plan will give you important things to consider. The questions may make you uncomfortable. Uncomfortable because you will remember all of the things you said you would do, but have not quite gotten around to completing. The numbers you so boldly forecasted may now make you wonder what you could have been thinking at the time. Don’t sweat it, many business owners feel the same way. But, there is good news for you.

Your business plan represented your best hopes at a point in time. You now have something real against which to compare it. Rewriting a business plan is not nearly as daunting as starting one from scratch. If you have never written one at all, developing a business plan is actually pretty easy once you are in the business. There is a lot less guessing before you have experience and now your numbers will be a lot more realistic.

There is even software available to automate the process of developing a business plan. At the end of this article I will point you to some I respect and in which I have no ownership interest.

But, you may ask, why would I want to write a business plan, or even update an old one? The answer goes less to planning and more to thinking. Using the business plan as a framework simply focuses ideas and innovation more easily.

A New Look at an Old Plan

In this article we are going to look at a few of the common components of typical business plans and restructure them into points of focus on current challenges you may be facing. By reworking the key elements of a business in your head, you will come away with a clearer awareness of your business. It will help you understand exactly what you need to focus on and help you develop a plan for growth.

Typical Business Plan

Question #1:

Describe your business and the products or services you plan to offer.

How does the answer to this question today differ from the day you started? What have you learned in the interim that might have caused a shift, if any? How involved did you plan on working in the day-to-day operation of your store or stores?

As you rewrite this section of the business plan, try to focus on your role as the owner of a business that sells tires and service rather than someone who actively manages the process. It may not be possible for you to extricate yourself from the process right away, but remember this is a business plan not a contract. Plan what you want to do with your business – and your life – in this exercise.

Typical Business Plan

Question #2:

Who are the players in your company and what roles do they fill?

As you list the players, make a note beside each name as to what percentage of their efforts requires input from you. If you have to tell them to do everything that you want done, you might feel important (indispensable) in your role as the head honcho, but it is a quick ticket to entrepreneurial insanity. You will be trapped in your important role and will have absolutely no freedom to do your own work (except after hours when everyone has gone home) or take a day off, or take a vacation or, some days, even be able to think!

As you rewrite this section of your plan, think hard about those who require the most and the least handholding. If you can remember, make a list of the last five questions each of them has recently asked you. Then, for each question, ask yourself, if you had a policy or system to which the employee could have referred before the question was asked, would you have had to be involved at all?

As an interesting exercise, try to “price” each decision you made for the employee. How much would it have cost to have let the employee make his or her own decision – and be totally wrong? Rarely are decisions totally wrong, but to prevent even a small percentage, most business owners will not allow that chance. And, it consumes them.

What policies could you put in writing that would eliminate a high percentage of your involvement with the kinds of questions you deal with daily?

It may not seem like much when you are running a single store, but what would happen if you opened a second one, or a dozen? To whom would the employees go for answers? This is the key to a growth mentality. It is the difference between owning a business and owning an asset.

Typical Business

Plan Question #3:

What is your growth strategy? How large is your market?

Your review of this topic invites you to look at the subject with a different set of eyes than you did when you first wrote your plan. It is likely that your vision was narrow and focused. There is nothing wrong with that in a start-up. Few people are capable of broad vision at that phase. It is likely that Sam Walton never dreamed of the scope of his eventual empire when he opened his store in Arkansas. Somewhere along the line, however, he discovered that his style of management could be duplicated and that was the turning point.

Whether you can develop an enterprise the size of Walmart or not, the pattern is the same. You, like Walton was a few billion dollars ago, have been in the business a while and it is time to do something different that will help you achieve a level of freedom. As you look at your growth strategy, what are the possibilities?

Can you duplicate what you are doing in other locations? This is the most typical expansion model, but it may or may not be the most profitable path for you. If you do this, you will need to have the systems down pat.

Can you expand what you are doing and develop a whole new set of customers? For example, having a business where customers leave their cars and frequently do not sit and wait for them could open the opportunity to add a line of services made possible with a longer leave-time for the car. This might include washing, waxing or detailing, for example.

Or, if your location is close enough to the airport, offer a series of “while you are gone” services that include keeping the car safe while the owner is away. Allowing the cost of your services to offset the cost of paid parking, might generate more sales – and goodwill.

With expanded profit centers, the need for written systems is increasingly necessary. Growth without systems can be very expensive.

New Eyes

Digging out that old business plan and looking at it with new eyes may clear a bit of the insanity with which you are living in keeping your business going today. Reviewing the plan with an experienced entrepreneurial mindset, thinking strategically, you are likely to see your business as potentially much larger than you ever have before.

Over the years I have seen dozens of business plan software systems. If you do not have a plan to dig out and think it might be a good time to put one together, I will simply suggest that the program put together by Burke Franklin at Jian Software is economical and very easy to use. To judge for yourself, visit rogermcmanus.com/business-plan.

Article courtesy of Tire Review.

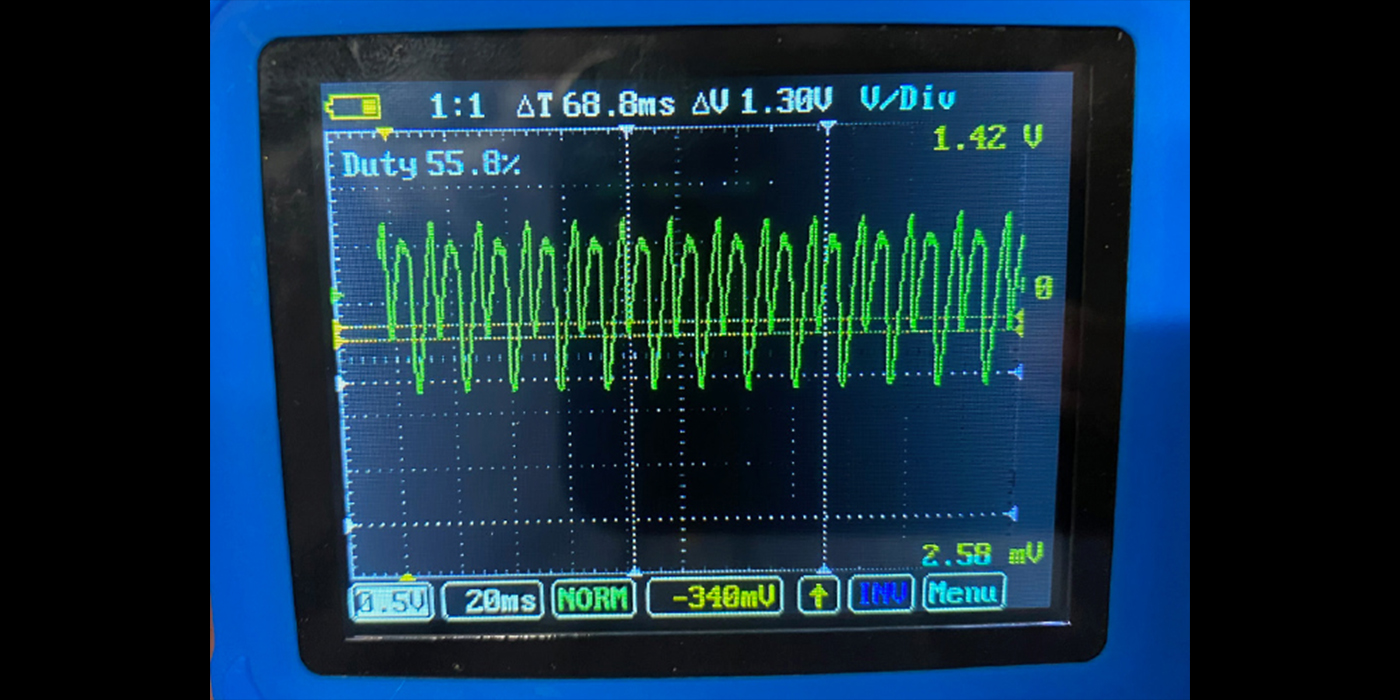

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.