By George Hedley

When companies don’t get the bottom-line results they want, it’s usually not their competition, the economy, or their people. Its’ usually the leader who has gotten stuck in their old ways of doing business and not willing to try new ideas or change.

When companies don’t get the bottom-line results they want, it’s usually not their competition, the economy, or their people. Its’ usually the leader who has gotten stuck in their old ways of doing business and not willing to try new ideas or change.

Start At The Top

Company owners are 100% responsible for everything in their company: sales, project specialties, profits, growth, quality, customer service, organizational systems, people, productivity, cash-flow, and management. In other words, the buck stops at the top of every company. Weak leaders blame poor results on circumstances beyond their personal control. Weak leaders sit and wait for something to happen, their customers to call, the economy to turn around, or some other miraculous event; while they don’t do anything different or decisive. Leaders have to make it happen. Now! (Or never.)

I drove by a well-located Sears department store recently. The parking lot was empty while the rest of the shopping center was jammed full. Sears can blame their slow decline over the last 25 years on Wal-Mart, Target or whatever competitor or economic condition they want. But in reality, the leaders of Sears were stuck in the past and made decisions to stay the course. Rather than trying new markets, innovative products, or unique concepts, they kept keep offering the same tired products, average service, old ways of doing business the same comfortable way, and not changing their business model. The leaders hoped the economy would get better, their new competition would go away, and customers would keep buying from a business that was old and out of touch. The leaders didn’t do what they needed to do. No vision or innovation. Afraid to try new things. They got eaten alive and now continue to scramble to keep up with their competition. It won’t happen. It’s too late. Maybe their merger with K-Mart and fix their problems someday. I doubt it!

Change Me First

Getting great results in any economy is an indicator of the leader’s vision, innovation, and performance. Real leaders make quick decisive decisions to adjust how they do business to stay ahead of changing business climates. Poor leaders wait for something to happen and complain about everything except their own performance. Business owners rarely come into the office on Monday morning and say, “I’ve made a big decision, I’ve decided that I need to change: how I manage, how I lead, and the direction of my company.” Poor leaders walk into the office and say things like: “My employees aren’t making it happen. My customers aren’t paying us fast enough. My competitors are too cheap. I can’t make enough profit in this economy. Everyone will have to work harder. We’ll have to cut our costs.”

Effective leaders realize they must have the courage to change themselves first before anyone will follow their lead. They must have a vision of where they are going, be willing to try new ideas, quickly change their behavior, be willing to try new markets, go after new customers or project types, do something different, innovate, try new methods, and go against the grain. Over ninety percent of employees rate their company leadership below excellent. Employees don’t see business owners taking charge and going for the winner’s circle as the going gets tough. Top companies have leaders who continually look for new ways to improve, new customers, new services, and new ways to be different than their competition.

Are You Doing Something?

I speak at a lot of conventions to entrepreneurs, small business owners and manufacturing companies. Their common business challenge is how to make an above industry average profit. Making good profits and getting bottom-line results start with the business owner having a dynamic and focused vision people can get excited about. People want to be a part of something exciting and will follow leaders on a mission. They won’t follow someone who is negative and complains about all their problems they encounter.

Leaders who really do something, stand up and say: “Here’s where we’re going, and here’s the changes we need to make and how we’ll make it happen.” Something people can really get excited about, instead of the standard: “Work hard and we’ll see how it comes out; and if we do well, maybe we’ll be able to stay in business and survive the downturn.” People get tired of repeating the same tasks over and over again without any excitement, vision, or passion from leadership – like digging a long ditch. And, when they’re done, they just get another ditch to dig. Then they’ll find some more ditches. This doesn’t make people excited about coming to work and making a difference in the bottom-line.

What’s Your Innovative Vision?

Effective leaders start with an exciting focused innovative vision and then connect it to specific results they want. Some companies have a vision to be the best company, the best contractor, offer the best service, or provide the best quality. While that’s an O.K. vision, it’s not exciting. Examples of exciting visions: Be the leader in cutting edge technology and innovative solutions providing our customers a better finished product. Be recognized as the leader in multiple and diverse types of products.

What’s Your Target?

After defining your exciting vision, specific results must be targeted to quantify exactly what’s expected. For example, if your vision is to provide the fastest service and best quality, determine what specific measurable results would enhance your bottom-line. Some specific targets can include: a referral from every customer, only five percent callbacks, no installation errors, or 98% on-time completion. What specific targets and numbers can you shoot for to realize your vision and get the results you want? Without specific clear targets you won’t get the results you want. Your people really don’t know what ‘try to do quality work’ or ‘be the best’ really means.

Ask the people who work for you: “What’s the innovative vision of our company? What are we trying to accomplish? What are our top three priorities? What specific targets are we shooting for? What results are important?” You’ll get 37 different answers if you have 37 people in your company. To get bottom-line results, get everyone on the same page from top to bottom. Leading and getting the results you want starts with you. Change, innovate, and try new ways of doing business, new projects, new customers, and new markets. Communicate your clear exciting vision. Define specific targets with expected results. And make it happen!

It’s Time To Stop The Buck

Sit down and write out your innovative vision. List out specific targets and goals you want to hit. Look at your customer and and project targets and decide if you need to change them. Write down a few new things you are going to try to boost your business over the next two years. Then create an action plan to make it happen. In other words, do something positive that will take your company somewhere. You can sit and wait, or stand up and get your company moving again. What’s your choice? Only you can decide if you will stop or start the bucks rolling your way.

George Hedley is the best-selling author of “Get Your Business to Work!” available at his online bookstore. As an entrepreneur, popular speaker and business coach, he helps business owners build profitable companies. E-mail: [email protected] to request your free copy of “Winning Ways To Win More Work!”

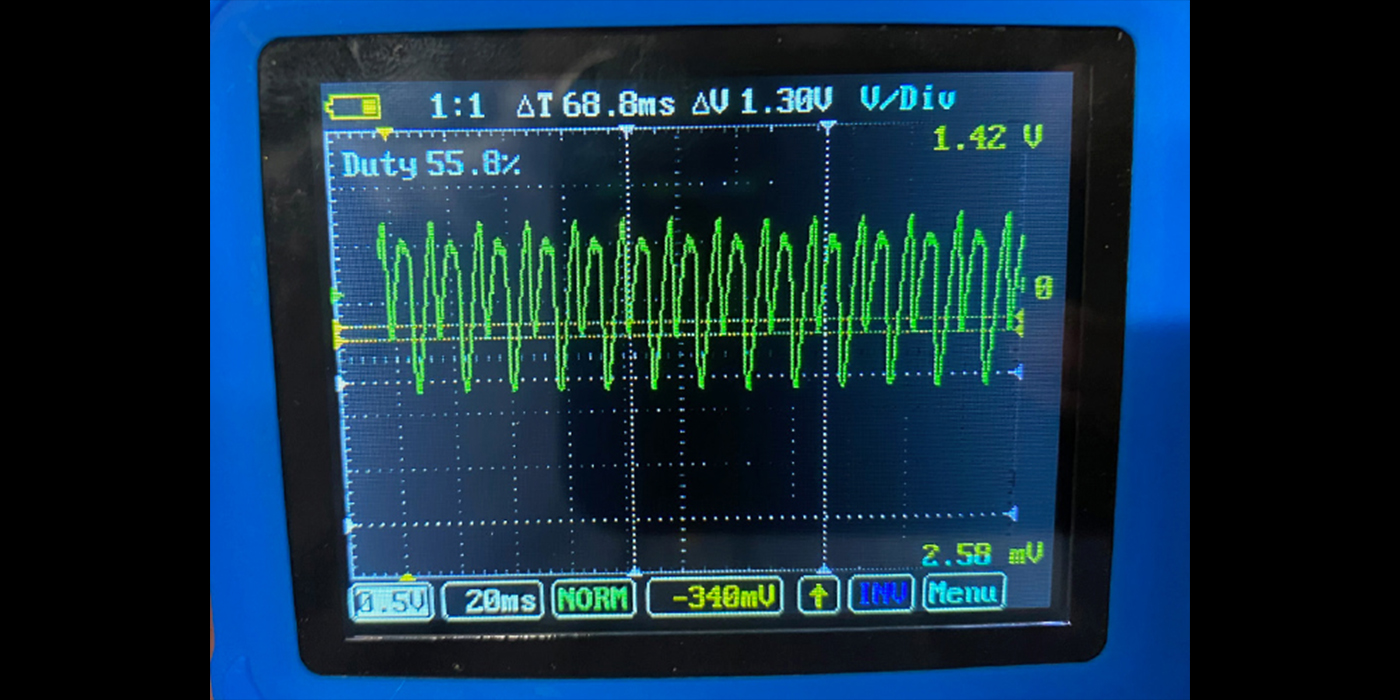

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.