Small business identity theft is a big business for identity thieves. Just like individuals, businesses may have their identities stolen, and their sensitive information used to open credit card accounts or to file fraudulent tax refunds. As such, small business owners should be on guard against a growing wave of identity theft against employers.

At some point, most small-business owners will visit a bank or other lending institution to borrow money. Understanding what your bank wants, and how to properly approach a loan officer, can mean the difference between getting the money for your shop expansion plans or having to scrape through finding cash from other sources.

Can you point your company in the direction of financial success, step on the gas, and then sit back and wait to arrive at your destination? Not quite. You can’t let your business run on autopilot and expect positive results. Any business owner knows you need to make numerous adjustments along the way. For example, there are decisions about pricing, hiring, investments, and so on.

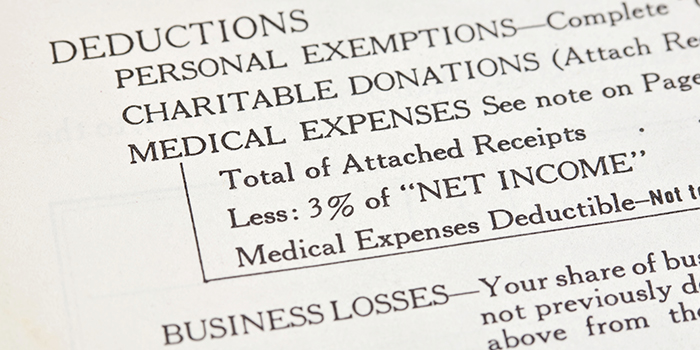

While the fate of several business-related tax extenders such as Research & Development tax credits, bonus depreciation, and Section 179 expensing that expired at the end of 2014 is uncertain, there are still a number of end-of-year tax planning strategies businesses can use to reduce their tax burden for 2015.

You may be tempted to forget about your taxes once you’ve filed your tax return, but did you know that if you start your tax planning now, you may be able to avoid a tax surprise when you file next year? That’s right. Now is a good time to set up a system so you can keep your tax records safe and easy to find. Here are six tips to give you a leg up on next year’s taxes.

Can you point your company in the direction of financial success, step on the gas, and then sit back and wait to arrive at your destination? Not quite. Any business owner knows you need to make numerous adjustments along the way – decisions about pricing, hiring, investments, and so on. So, how do you handle the array of questions facing you? One way is through cost accounting.