Are you paper rich but cash poor? A business can be profitable on paper, but bankrupt in real life – if you don’t manage cash flow effectively. Without cash, a repair shop will inevitably shut down, regardless of how profitable it looks on paper. You can be “rich” in accounts receivable and inventory, but cash poor if these assets are not convertible into cash to meet current obligations. In fact, cash is the only asset a company needs to stay in business.

As an expert in your business, you can play a valuable role in staying engaged and working in partnership with your broker. While some brokers, especially those who sell commercial real estate, go out of their way to keep buyers and sellers from directly interacting, this is rarely the best method to achieve a successful sale of a business in the shortest amount of time.

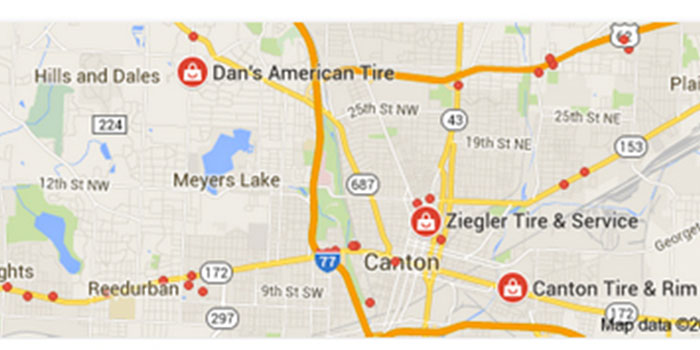

Going online for any service is the new norm with almost every consumer owning a smartphone. With today’s technology, information can be accessed almost anywhere, making a major purchasing or scheduling decision a click away. Searching the Web for repair shops and tire dealers is gaining momentum, making a functioning and user-friendly website more important than ever for your shop’s livelihood.

Social media followers are proven to be more engaged with video than any other type of posting, meaning they “Like,” comment or share video posts more than any other type of posts. More engagement means more branding opportunities for your business. And, when handled correctly, websites that add fresh video regularly also see their rankings go up. These should be compelling reasons to add video to what you do online.

According to a recent article in The Wall Street Journal, some CEOs are starting to understand the price they have to pay for quick profits, and many of them are now taking a different approach. Although all companies should consider their long-term growth and financial stability, there has been an ongoing challenge that today’s CEOs face – the relentless demand for immediate profits that is put on them by their stockholders.