By Bob Cooper, president, Elite Worldwide, Inc.

Over the last 22 years, I’ve been amazed to discover just how many shop owners are lost when it comes to knowing and understanding “the numbers.” In order to build a successful auto repair shop, you are going to need to know two sets of numbers: your “financial” benchmarks, and your “operational” benchmarks.

Without a clear understanding of these benchmarks, it becomes quite challenging for shop owners to pinpoint where they are falling short of their goals, and where improvements need to be made. Far too many times, I’ve seen shop owners finally start monitoring these numbers closely, and quickly realize that for years they haven’t been charging enough for parts, have been overpaying their employees, have been operating inefficiently, etc.

There’s no doubt about it: A clear understanding of your shop’s financial and operational benchmarks is critical to effective auto repair shop management.

Since your parts costs are one of your largest expenses, it’s something you need to monitor continuously. At Elite, our top clients spend no more than 52% of the dollars they bring in through their parts sales, on parts costs. This means that if they bring in $40,000 in parts sales by the end of the month, the cost of those parts should not exceed $20,800 ($40,000 in parts sales x 52% = $20,800 parts costs.) If you find you are spending more than 52% of your parts sales on parts costs, then you need to take a good, hard look at how you price your parts, any parts that are being replaced at no charge, your warranty failures, purchasing habits and the possibility of theft.

When it comes to your direct labor (the cost of your techs), the top shops we work with spend no more than 40% of the dollars they bring in through labor sales, on technician pay. This means that if they bring in $40,000 in labor sales by the end of the month, their technician payroll does not exceed $16,000 ($40,000 in labor sales x 40% = $16,000 labor cost).

You also need to pay close attention to the cost of your service advisors, and here at Elite, we like to see that number at no more than 8% of your total parts and labor sales. For example, if your shop generates $80,000 in monthly auto repair sales, your advisors should not be costing you more than $6,400 ($80,000 total sales x 8% target = $6,400 advisor cost).

You’ll need to watch your “operational” benchmarks very closely as well. One key indicator is your labor hours per repair order, and our top clients consistently generate at least 2-2.5 hours of labor sales with their average repair order. If you are not seeing 2-2.5 hours per repair order at your shop, you need to review your vehicle inspection process, what’s being recommended to your customers and the declined services.

As a shop owner you also need to pay close attention to your technicians’ “efficiency” rate. This is a powerful key indicator that will show you just how good your techs are at getting the work done in a fast and effective way. It’s easy to discover your efficiency rate by simply dividing the hours you billed for the repair, by the amount of time it took your tech to complete the job.

For example, if you bill a customer 2 hours, and your tech gets the job done in 1.5 hours, he would be 133% efficient (120 minutes billed/90 minutes to complete the job = 1.33, which is 133% efficient).

The top shops are typically operating at an overall efficiency rate of 125+%. There are a number of things that can bring down the efficiency of the technicians in your shop, including a lack of experience, the lack of proper technical training, and one of the biggest culprits, the wrong compensation programs.

And lastly, after you pay all of your expenses, the money that is left over is for you. In business we call that profit, and the top shops will typically earn a profit of 15-20% of sales. So if your shop is generating $80,000 in monthly sales, in most cases, you should be able to earn $12,000-$16,000 per month in taxable income. The good news is, if you know your numbers, and if you never put money ahead of people, you should be able to generate these profits in a professional and ethical way.

Since 1990, Bob Cooper has been the president of Elite Worldwide Inc. (www.EliteWorldwideStore.com), an ethics-based company that helps both struggling and successful shop owners take their businesses to new levels through one-on-one coaching from the industry’s top experts. The company also offers shop owners sales, marketing, and management seminars, along with service advisor training. You can contact Bob at [email protected], or at 800-204-3548.

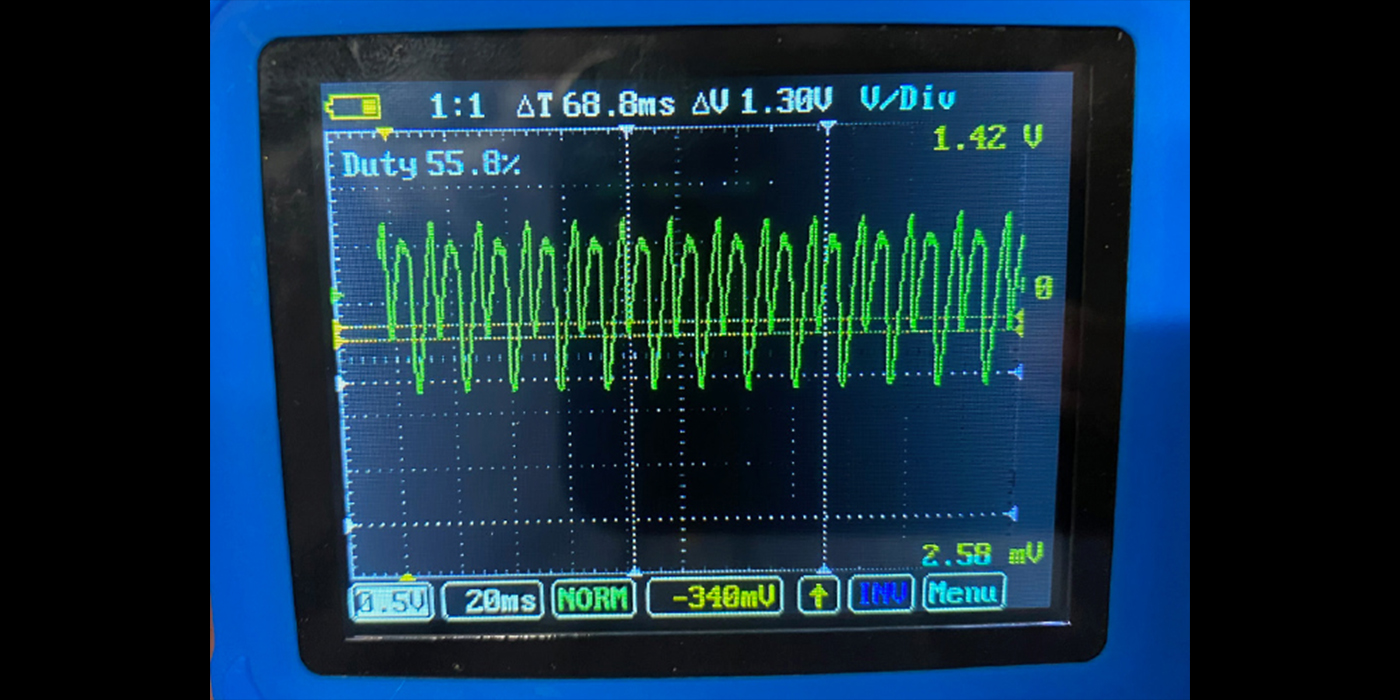

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.