I recently asked a friend in his late 50s about his plans for retirement. He told me he expected to die at his desk – and he was serious. He gave no thought to a time when he wouldn’t be in his business.

Part of being a proactive business owner requires that you look a few moves down the chessboard – whether that means keeping the business in the family, turning it over to a management team so you can golf more or selling the business.

At this time of unprecedented industry consolidation, many industry professionals are selling their businesses. For any shop owner contemplating a future sale, even years down the road, there are a few things you should think about to get your business ready.

Need a Boat?

You’ve heard the old-school shop owner talk about how he used to handle business finances, right? The story goes that one front trouser pocket was for incoming cash and the other was for outgoing expenses. Whatever was left over at the end of the month was “profit.”

Because one of the key factors in determining the value of a business is profitability, it’s critical that a shop’s records accurately reflect the financial health of the company. Records that are maintained well for a period of years (rather than months) are helpful because they can reveal trends and explain aberrations.

Poorly maintained financial records are especially problematic for business owners who take cash from the business “off the books” to lower their tax burden. If there is no documentation of your true earnings, and what you claimed as income in your tax return under penalty of perjury was lower than your actual income from the business, it’s difficult to make the case for a higher valuation based on the “real” numbers in a sale transaction.

Similarly, many owners run personal expenses such as dry cleaning, boats and ATVs through the company and call them “business expenses” on their business tax returns. Not only is this potentially illegal (if not a legitimate business expense), but it may present downstream income tax exposure for the buyer of your business in the event of an audit after a sale.

In addition, if you formed your business as an LLC or corporation, you created a separate legal entity to shield you from personal liability (protecting your house and savings accounts) in the event you were sued by, say, a vendor or customer. However, your legal protection may be erased if it can be shown that your business expenses and your personal expenses are one in the same (commingled). This is called “piercing the corporate veil.” In the event of a possible sale, your legal entity status will be important because certain legal entities may give rise to double taxation.

Also, many buyers don’t purchase the real estate when they purchase a business – they lease it back to the owner. Therefore, if you own the business and the real estate, the legal entity status that you operate under (and whether you commingle business operating assets with your real estate) may have significant tax consequences.

The time to talk to your accountant, tax professional and legal counsel is now, even if a sale may be a few years down the road. You may be able to make adjustments in your legal structure now that afford you a more favorable treatment in a future sale. Plus, cleaning up your books and undertaking bookkeeping best practices creates a much clearer financial picture in the event of a sale – and may save you some grief in the event of an audit.

Get Your House in Order

Some business owners struggle with whether they should sink money into the business when they think they might sell it. Maybe that’s you? You know you want to sell, but you just don’t know when. But let’s focus on what you do know: The condition of your equipment, whether the parking lot needs to be repaved and whether the plumbing in the employee bathroom is unreliable.

Even if you own your real estate and plan to lease it back to a future purchaser of your business, the way your property, building and equipment are treated in the deal is not unlike the way total losses are calculated. Just like the car owner doesn’t get “credit” for regular oil changes or headlights that go on and off, there is a presumption that your space is in good working order. You don’t get credit for that – it’s expected. While a purchaser of your business will assume they need to invest in new trade dress such as paint colors, signage and design features to make your space fit their design, they will also expect that you maintained the property. If there si significant deferred maintenance, you can expect it will be a deal point. Either you take care of it (at your cost) or the buyer deducts it from the purchase price.

Even with uncertainty about when you may exit the business, why not create the best possible first impression for your customers and a pleasant workplace for your employees in the interim? You’re paying for it, anyway.

Due Diligence

After business valuation, the issues that dominate most sellers’ thoughts are a compatible business culture and integration of the business. This becomes most important when the seller plans to stay on in some capacity with the acquiring company or where the seller does not intend to stay but is looking out for his or her employees who want to continue working with the acquiring company.

If you want to know how consolidators or a regional player who might view you as a great strategic add-on tread the employees of newly acquired companies, just ask. More often than not, the express terms of an acquisition deal will be subject to a non-disclosure agreement. (This is why you often hear different numbers about the purchase price in industry deals – they’re a product of hide-and-seek played by those in-the-know who do not want to breach the agreement and the speculation by those who actually know very little.) However, simply asking the employees or sellers who stay on with a buyer about their experience under the new regime is fair game.

A potential seller who is considering a sale should consider attending local and national industry events to find natural opportunities to speak to sellers or employees of selling companies about their integration in a post-acquisition environment. Better yet, do it over time. Recognize that a seller’s view three months after an acquisition may be very different 12 or 18 months down the road. In many cases, sellers will ask for employment contracts (customarily six to 12 months) for themselves or key employees who will be staying with the acquiring company. It’s not uncommon for those employees to leave for personal reasons after the contract ends, at the behest of the acquirer or both. Keep in mind that sometimes, the reason for parting ways may also be subject to a non-disclosure agreement.

There are instances where sellers refuse to even consider an offer from a potential buyer because of rumor or a perception (accurate or not) that the buyer will not take care of them or their employees. For this reason, it’s important to get information about culture and integration in advance, before you’re approached by or prematurely eliminate a potential suitor.

Time to Say Goodbye

The sale of a business does not always occur when or how business owners expected. In many instances, owners who gave little thought to a sale are approached by a potential buyer and suddenly, they’re in the game. In other instances, sales occur during times of desperation, when businesses are struggling.

It’s always possible to do a “back-of-the-napkin” analysis of the value of your business within a likely range, recognizing that there are a myriad of factors influencing the actual offer. Many people mistakenly believe they’re sitting on a gold mine. Sometimes they’re right, but more often they’re wrong.

Experience shows that valuation is not what tells people it’s time to sell; it’s what they feel in their heart that speaks to them. Until that time comes for you, be realistic about where your business is now and where you want it to be, and plan ahead. If it’s not time to say goodbye, look at how you can build up your business and preserve value.

Article courtesy of TIRE REVIEW.

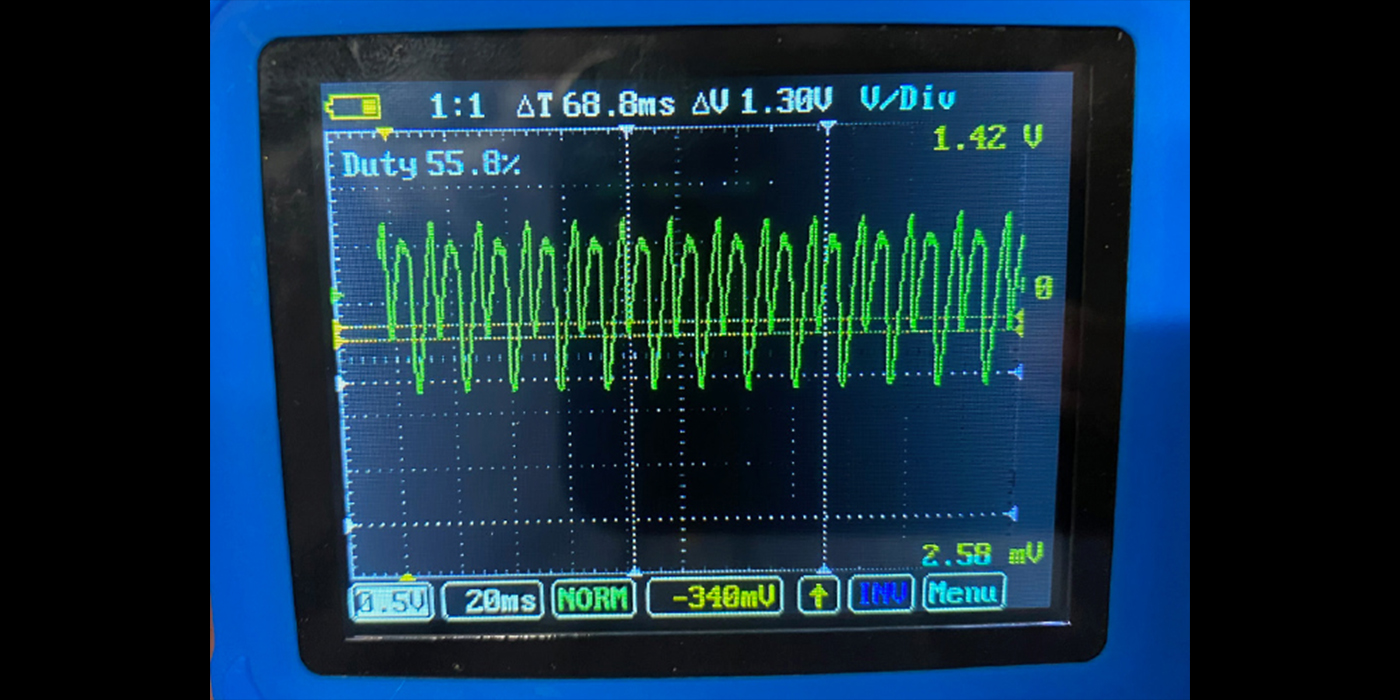

I’m not a financial scholar by any means, but I know what return on investment (ROI) is. It’s a mathematical formula that yields a representation of the profitability of any type of investment. In the automotive repair industry, we primarily associate this with equipment. Admittedly, I’ve never used the term much, more often approaching things from the standpoint, “Am I making money with this or not?” As technicians and shops, our typical thought process centers on each individual job, how much time and money we have into it, so we’re used to thinking profit or loss, and also pretty good at knowing if we made money, or if we lost our “back quarters.”But over time I’ve learned that the thought process alone is not always the best approach, and making money doesn’t necessarily mean a good ROI. Even if you don’t go crazy with an exponentially long, complicated equation, if you understand the basic idea and process of calculating ROI, it can help you make good purchasing decisions. The base calculation would be dividing your net profits by the cost of the equipment. That’s your ROI. Then, if you want to take it further, you can divide that number to get a time-based ROI average.Let’s look at a basic calculation. You buy something for $10, then sell it for $14. Your profit is $4. Divide profit by investment, ($4/$10) and you get an ROI of 40%. Not bad, but if it took two years to make this profit, then your ROI would be 20% annualized, which is not as impressive. You can use this basic formula to compare products you sell as well, and it may help you decide what’s best to keep in stock or not.Now let’s try something with equipment. You have an old tire machine that’s paid for. You average one set of tires per week and it takes 1.5 hours to complete the job. You decide to buy a new tire machine that is much quicker and more efficient but it cost you $20,000. Now the same job only takes one hour. Based on the cost of technician salary, you calculate that it saves you $30 per job with this new equipment. In this case you would use the formula: savings (additional profit)/investment. At one set of tires per week, that works out to $1,560 per year. $1,560/$20,000 equals an ROI of approximately 8%. That’s not too good. It will take you almost 12 years to pay off the new machine.On the other hand, if you average five sets of tires per week, then your additional profit for the first year is $7,800. $7,800/$20,000 equals an ROI of 39%. That’s pretty good. A general rule of thumb is to pay off any piece of equipment within two to three years. This puts you right on track.But now, here is the problem. This is where we throw the proverbial wrench into the plans. Equipment is tricky. You should also calculate in installation and maintenance costs, as well as the cost of training for the new equipment, and factor in how long the equipment is going to be relevant. This is an especially important factor when considering a scan tool, the required updates and how long before it’s potentially obsolete. In the case of a tire machine, you can also calculate in savings from other benefits of a new machine, such as no more damage to wheels or tire pressure monitoring system (TPMS) sensors, which the new machine can eliminate.Some of this can be overwhelming, and it makes me realize why it’s easier just to fly by the seat of your pants and wonder, “Am I making money or not?” It’s an important business aspect, however, to know what is behind the idea because it can benefit you in so many ways. Even without math, you can almost visualize the numbers in your head.I’ll try it by leaving the formulas out to decide whether it makes sense to buy a dedicated TPMS tool when you already have a full-function scan tool with TPMS ability.If you get a TPMS problem every day and you use your full-function scan tool to diagnose it, most likely it takes much longer to boot and longer to navigate to the function. Even then, it may not cover all you need. Because there’s such a vast amount of information that a full-function scan tool has, it simply takes more for the manufacturer to keep everything current. Plus, you often must still rely on service information for certain procedures and then, if it’s the only scan tool for your shop, it ties it up for use in other diagnostics.Now, let’s compare that to a dedicated TPMS tool. Built with only one function in mind, they can make the process much quicker, have greater coverage, boot quicker and quickly walk you through all steps of any required TPMS resets. When you factor in the savings in time and the fact that your primary scan tool isn’t tied up, you can prove the value of a dedicated TPMS tool through ROI calculations. On the other hand, if you rarely work on TPMS systems, you can prove it wouldn’t make sense at all, since you do have the function on your primary scan tool.While you haven’t done any calculations, you’ve thought of it in that manner and can picture where the calculations might end up. If you’re on the fence, the math will give you the answer. Ultimately, your accountant could take the idea even further, with an undoubtedly more advanced knowledge of ROI, and almost certainly a way to calculate depreciation into the formula. That’s where I sign off, but you get the idea. It’s a great concept that represents fundamental business financials.